Real Estate Investment in Karachi: Strategies for Smart Investors in 2025

Introduction

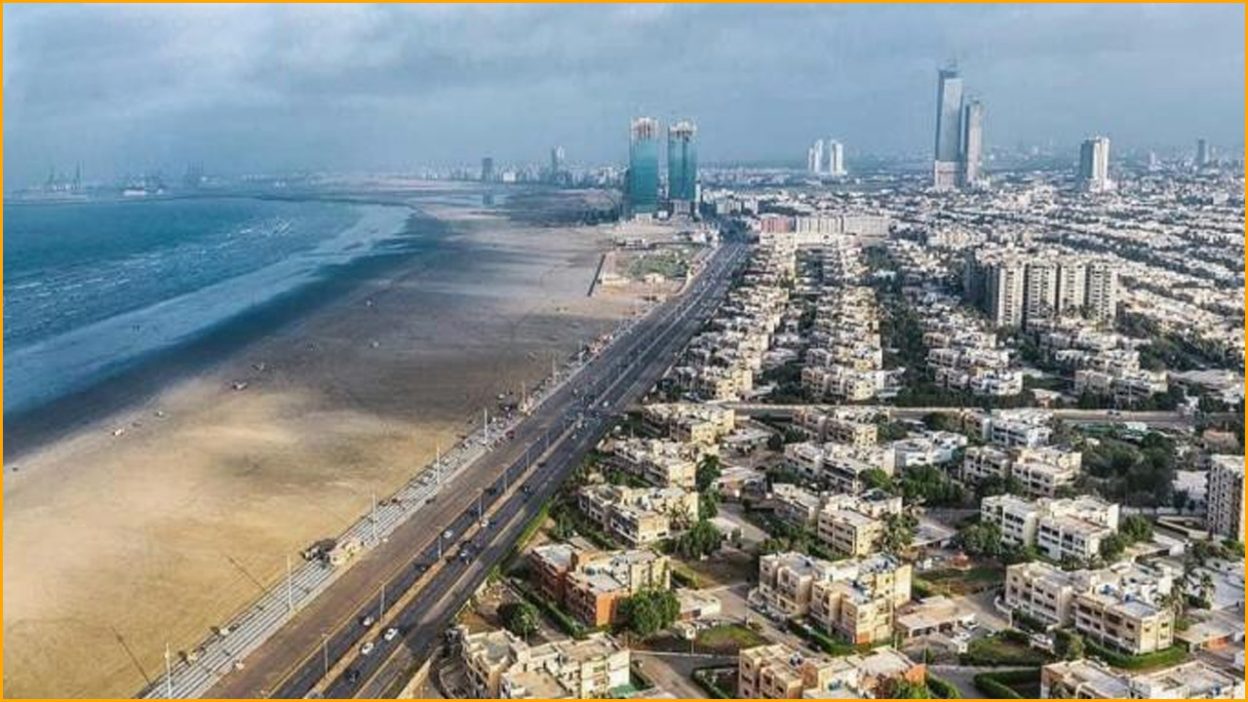

Karachi, Pakistan’s largest city and economic powerhouse, continues to be a magnet for real estate investment. Its dynamic market, population growth, and expanding infrastructure present countless opportunities for both local and international investors. In 2025, the city’s real estate sector is evolving rapidly—with mixed-use developments, gated communities, and commercial zones leading the way.

Projects like Falaknaz Greens, One Beverly, and The Mega Mall are not only redefining modern living but also delivering solid returns for strategic investors. In this blog, we break down the key trends, risks, and strategies you need to know to make smart real estate investments in Karachi today.

Why Karachi Is Still a Real Estate Hotspot

Consistent Population Growth

Karachi’s population exceeds 20 million and continues to grow. The demand for residential and commercial properties remains strong.Economic Hub of Pakistan

As the center of commerce, trade, and industry, Karachi attracts professionals and businesses alike, creating a constant need for housing and office spaces.Infrastructure Improvements

With projects like the Hyderabad–Sukkur Motorway and public transport upgrades, access and mobility across the city are improving—boosting land values along transit routes.High Rental Demand

Whether it’s short-term rentals in upscale areas or long-term leases in affordable apartments, Karachi’s rental market remains active and profitable.

High-Performing Investment Segments

Luxury Apartments

Projects like One Beverly offer premium amenities, prime locations, and high rental yields—ideal for investors targeting professionals and expats.Gated Communities

Falaknaz Greens combines security, greenery, and community living, making it a top pick for families. These developments maintain steady appreciation due to high demand and limited supply.Commercial Retail Units

Located in high-footfall areas, The Mega Mall presents an excellent investment opportunity for those seeking commercial rental income from branded outlets and businesses.

Investment Strategies for 2025

Long-Term Buy & Hold

This traditional approach is ideal for those looking to build wealth gradually. Holding properties in growth corridors allows for both appreciation and rental income.Pre-Launch Investments

Early-stage investment in projects like One Beverly can yield significant returns by the time the project is completed, provided the developer has a strong track record.Rental Income Model

Buy-to-let remains a smart option. Properties near commercial hubs, universities, or hospitals tend to enjoy consistent rental occupancy.Diversified Portfolio

A mix of residential and commercial units across various projects reduces risk and improves your long-term return on investment.

What to Look for in an Investment Property

Location: Proximity to schools, markets, transport links, and business centers matters. Projects like The Mega Mall thrive due to central locations.

Developer Reputation: Trust in the developer ensures timely delivery and legal compliance. Falaknaz Group, behind Falaknaz Greens, has a history of successful projects.

Legal Status: Ensure the project has all necessary SBCA and regulatory approvals.

Facilities & Amenities: Properties with smart features, security, parking, and recreational areas retain higher value.

Future Development Plans: Invest in areas with upcoming infrastructure or commercial zones to maximize future appreciation.

Key Risks and How to Avoid Them

Fraudulent Listings: Always verify ownership documents and legal clearances.

Delayed Possession: Only invest in developers with a strong history of on-time delivery.

Inflated Prices: Avoid emotional buying; compare market rates and negotiate.

Low Liquidity: Invest in properties with high resale potential, such as units in popular developments.

Working with registered real estate consultants and legal advisors is crucial to avoiding costly mistakes.

The Role of Technology in Real Estate Investing

Modern investors are leveraging digital tools like:

Virtual tours and 3D walkthroughs

Online booking and installment tracking

Real-time market analysis and AI-powered property suggestions

All three featured projects—Falaknaz Greens, One Beverly, and The Mega Mall—offer strong digital interfaces for transparency and ease of transaction, especially useful for overseas investors.

ROI Expectations in 2025

On average:

Luxury apartments yield 6–8% rental ROI annually.

Commercial retail spaces can provide 8–10% in high-demand zones.

Gated community homes appreciate at 10–12% yearly with added lifestyle and security benefits.

Projects backed by recognized developers in key areas—like the Falaknaz Group—are leading these returns.

Overseas Pakistanis: A Golden Opportunity

For expats, Karachi is a strategic investment hub. With favorable currency exchange rates, increasing transparency, and digital accessibility, it has never been easier to invest remotely. Whether it’s a family apartment in Falaknaz Greens or a rental unit in One Beverly, these investments offer emotional and financial returns.

Final Thoughts

Karachi’s real estate sector is evolving fast, driven by urban demand, better infrastructure, and rising middle-class aspirations. For smart investors, now is the time to secure properties in landmark developments like Falaknaz Greens, One Beverly, and The Mega Mall.

By aligning with trusted developers, staying informed about market trends, and applying a long-term investment mindset, you can turn your property into a powerful wealth-building tool in 2025 and beyond.